REILink Flip Calculizer™

Analyze House Flips with Intelligence & Precision.

Don't just crunch numbers; understand true market viability. Our Flip Calculizer™ goes beyond basic math to factor in repair costs, ARV, MAO, timelines, and real buyer demand.

See How It WorksWhat is a Property Flip?

A property flip, often called "house flipping," is a real estate investment strategy where an investor purchases a property with the intention of selling it for a profit in a relatively short period. This typically involves buying a distressed or undervalued property, renovating or improving it (the "rehab"), and then selling it at a higher market price (the After Repair Value or ARV).

Successful flipping requires accurate estimation of purchase costs, repair expenses, holding costs, selling costs, and the final ARV to ensure a profitable outcome.

The Hidden Dangers of "Good on Paper" Deals

A basic flip calculator might show a tempting profit. A $50,000 projected profit in 4 months? Sounds great! But what if that calculation is missing critical context?

- What if no cash buyers in that specific market are willing to invest $300,000 for that type of flip, regardless of potential ROI?

- What if the property type (e.g., a large multifamily you plan to flip) has historically low demand from flippers in that zip code?

- What if your repair estimates are wildly off from local contractor rates or the actual scope needed?

- What if your ARV is based on outdated or irrelevant comps?

A deal that looks profitable in a spreadsheet can quickly become a financial trap if it ignores real-world market dynamics, buyer behavior, and accurate costings. This is where a simple calculator falls short.

The REILink Flip Calculizer™: Intelligent Analysis

Our Flip Calculizer™ isn't just about adding and subtracting. It's an intelligent engine designed to give you a true understanding of your deal's potential, factoring in the nuances that basic tools miss.

The Calculizer™ Difference for Flips

- Validates Your Inputs: Checks ARV, repair costs against market data and property condition.

- Interprets Realism: Flags if projected profits or timelines are unrealistic for the market or property type.

- Contextualizes Financials: Shows how your MAO, ROI, and profit margins stack up against typical buyer expectations in that area.

- Provides Actionable Intelligence: Suggests adjustments to make your deal more viable, powered by the REILink Insights Engine™.

- Integrates with Repair Estimator: Pulls your personalized, detailed repair costs for unmatched accuracy.

Analyze MAO, rehab margin, ROI, timelines, and more.

Key Features for Precision Flipping

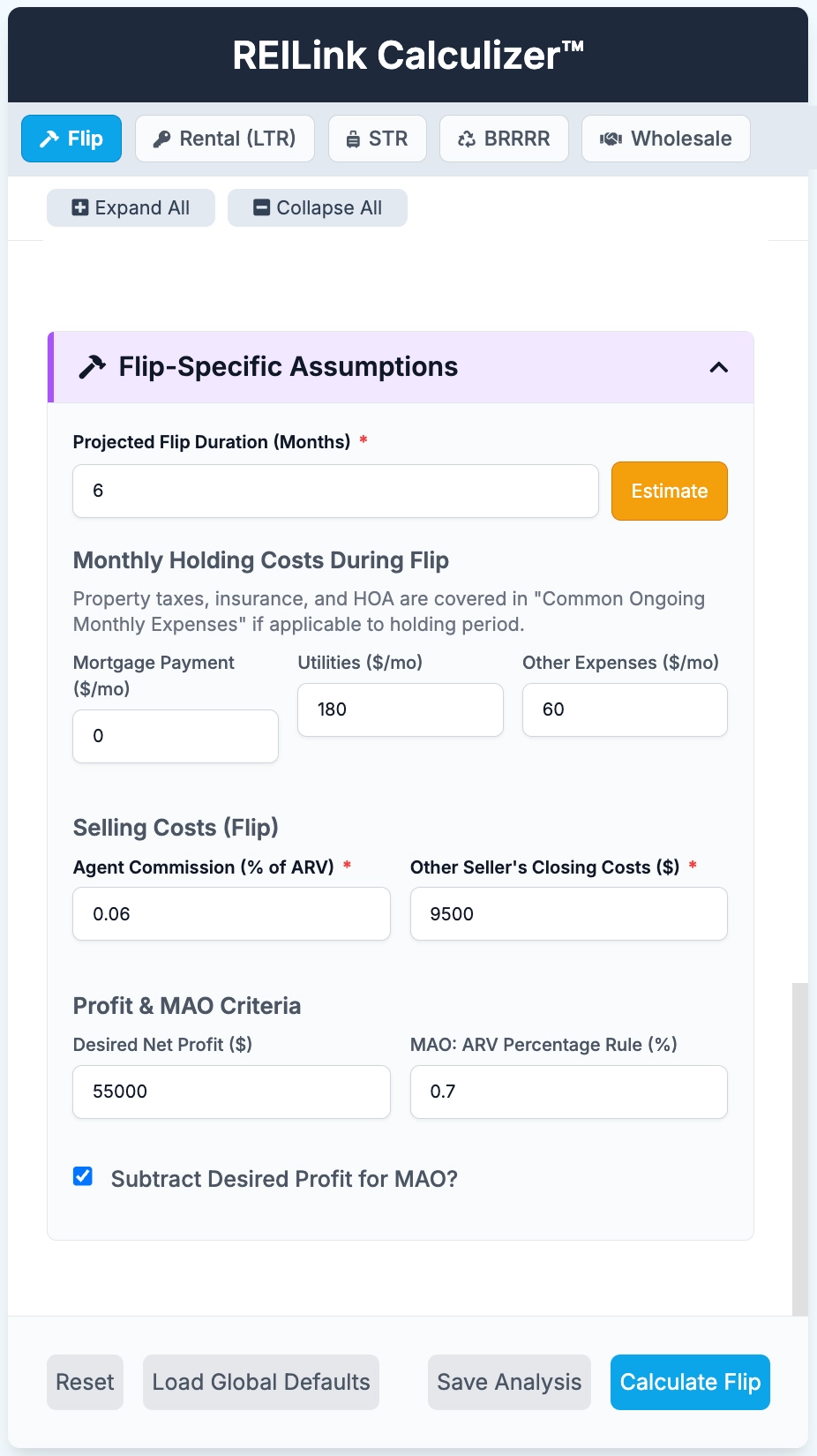

Accurate MAO Calculation

Determine your Maximum Allowable Offer based on desired profit, ARV, and all associated costs.

Detailed Rehab Margin Analysis

Integrates with your personalized Repair Cost Estimator for precise rehab budgeting.

Comprehensive ROI & Profit Projection

Clearly see your potential Cash-on-Cash Return, Net Profit, and Profit Margin.

Realistic Timeline Factoring

Account for purchase, rehab, and selling timelines to understand holding costs accurately.

All Costs Considered

Includes purchase costs, repair costs (with contingency), holding costs, financing costs, and selling costs.

Insights Engine™ Integration

Get warnings, hints, and suggestions based on market data, buyer behavior, and your user preferences.

Stop Guessing on Your Flips. Start Calculating with Confidence.

The REILink Flip Calculizer™ is more than a tool; it's your partner in making smarter, more profitable flipping decisions.

Explore All Calculizers™Part of the powerful REILink Deal Laboratory suite.