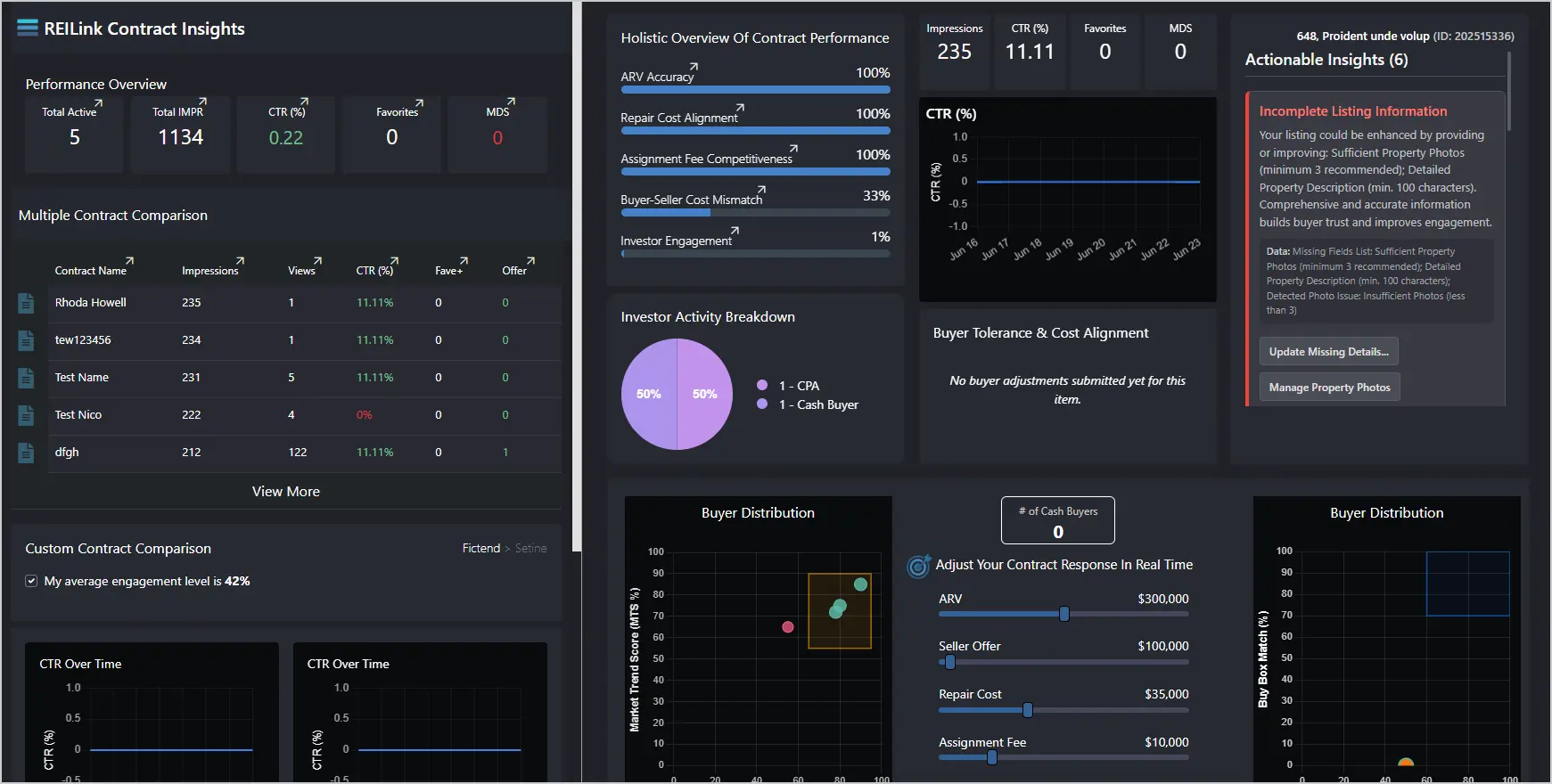

Unlock Your Deals' True Potential with REILink Contract Insights

Stop guessing, start closing. Dive deep into real-time analytics, buyer behavior, and market trends to optimize every contract for maximum profit and speed.

See Why It's a Game-ChangerThe Unfair Advantage for Wholesalers

This isn't just another analytics tool. REILink Contract Insights delivers REAL, ACTIONABLE data, telling you exactly what’s happening with your contracts and how to fix what isn’t working.

Create Deals Buyers ACTUALLY Want

Know what buyers are actively looking for. See which price points generate most interest. Spot hidden market trends to adjust your acquisitions and stay ahead.

Sell Contracts FASTER with Instant Fixes

High views, no clicks? Weak headline/image. Lots of clicks, no favorites? Pricing/terms might be off. Get instant feedback and fix problems before deals go cold.

Maximize Profits with Smarter Pricing

Compare your assignment fee to market averages. Test different fees to find the sweet spot for maximum profit while keeping demand high. Avoid pricing yourself out.

Target the RIGHT Investors

Know who's engaging: Flippers? Landlords? Hedge funds? Match deals to the right buyers. Find the best time to promote based on when investors are most active.

Dominate Your Market

See how your contracts compare to similar deals. Discover emerging trends. Secure the best contracts before everyone else by understanding true market demand.

Increase Closing Rates

See which investors are returning to view your contract—these are hot leads. Track engagement and follow up when interest is highest.

The 5 Layers of Contract Intelligence

1️⃣ Contract Analytics & Performance Tracking

Tracks views, clicks, favorites, contact requests, and engagement trends (daily, weekly, monthly, peak hours). Understand visibility and initial interest.

2️⃣ Contract Scoring System (REILink Scorecard)

Assigns numerical scores for attractiveness (CAS), engagement (IES), purchase probability (PPS), buy box match (BBMS), market demand (MDS), fee competitiveness (AFCS), and fast sale potential (FSPS).

3️⃣ Deal Troubleshooter (AI Fixes & Optimizations)

Diagnoses underperformance (e.g., high views, low clicks) and suggests specific AI-powered fixes like image changes, headline optimization, or pricing reviews.

4️⃣ Market & Buyer Matching Intelligence

Automated investor tracking (views, favorites, liquidity). Matches contracts to active investors’ buy boxes and segments buyers (flippers, landlords) for targeted marketing.

5️⃣ Monetization & Premium Features

Offers tiered access. Free users see blurred/simplified data. Paid users unlock full scores, detailed analytics, AI recommendations, boosted listings, and competitive benchmarking.

Visualize Success, Automate Action

Insightful Graphs & Reports

Daily/weekly engagement trends, heatmaps for peak marketing times, competitor comparisons, investor activity tables, market demand stats, and price benchmarking. Make data easy to absorb.

.webp)

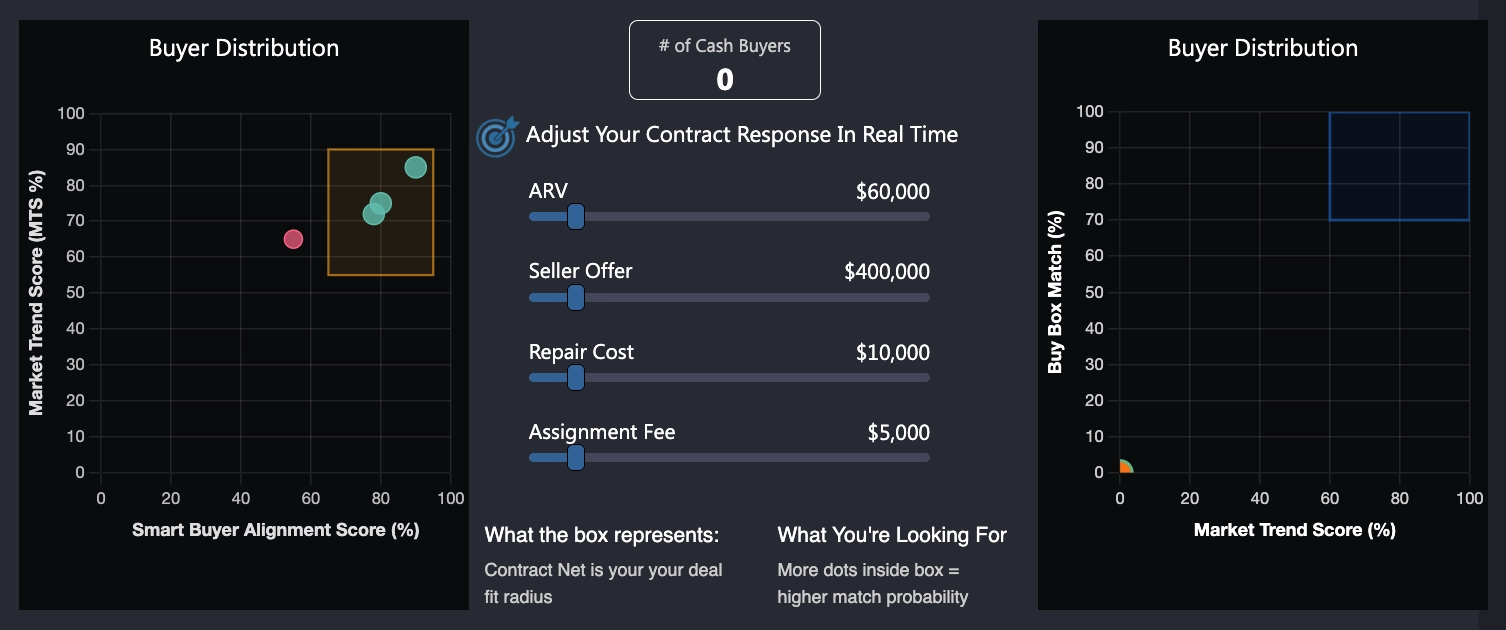

CastView™: Strategic Deal Positioning

Visualize your deal on a graph mapping market trends vs. investor preferences. See if you're in the "Buy Area." Simulate changes to ARV, repairs, or fee and see how tweaks shift your position. Get "One Click Fix" suggestions.

Automated Deal Improvement Alerts

AI-driven alerts monitor investor behavior. Get notified for low CTR, high ARV adjustments by buyers, or when MDS drops. Receive "One-Click Fix" suggestions to optimize deals before they go cold.

.webp)

Beyond Optimization: Smarter Acquisitions

Contract Insights isn't just about fixing current deals; it's a powerful feedback loop for your entire acquisition strategy.

Adjust Purchase Price Based on Buyer Behavior

If investors consistently pass on contracts priced above 70% ARV, refine your acquisition criteria to target properties offering better margins for your end buyers.

Identify Hot Markets & Untapped Opportunities

If a specific zip code shows high engagement and fast closings, focus your marketing and acquisition efforts there to capitalize on demand.

Know Which Property Types Perform Best

If single-family homes under $200K get the most investor interest in a target market, prioritize finding and securing similar deals.

Understand Cash Buyer Interest Patterns

If rental investors engage more than flippers, tailor your marketing and deal structuring (e.g., highlighting cash flow) to attract landlords.

By incorporating these insights, you make smarter buying decisions, improve profitability, and build a more resilient wholesaling business.

Stop Flying Blind. Start Closing Smarter.

REILink Contract Insights gives you the data-driven edge you need to thrive. Understand your market, optimize your deals, and maximize your profits.

Explore REILink & Get StartedPart of the powerful REILink Deal Laboratory suite.